A Rookie’s Guide to Getting to Retirement

I’m less than a month into my retirement, so take anything that I say with a grain of salt, but I feel that I’ve done a well-informed and solidly-planned job of getting to this point. If you’re one of the small percentage of people who don’t need to worry about finances in retirement for any reason, the following article might not be for you. Similarly, if you’re one of the small percentage of people who doesn’t ever want to retire, or don’t think you’ll ever be able to retire, it might not be helpful – although I’d caution that just because you don’t intend to retire doesn’t mean that you won’t be forced to do so by a health condition, an economic trend or some other factor outside of your control.

I’ve been planning to retire ever since I started working. That’s not as sad as it sounds. It wasn’t that I didn’t want to contribute to the broader world, but rather than my family and peers impressed upon me the need to start saving and planning for it early.

I’ll start off with some factors specific to my situation as a framework, and then provide some more general advice that I think applies to just about anyone. I hope it is helpful.

My Specific Circumstances to Get to Retirement

The Disingenuous Part – I’m not really retiring. I still expect to work at least 40 hours a week, albeit in the area that has been a really fun side hustle for more than two decades. I love fishing and traveling and writing about fishing and traveling. I’m fortunate that I’ve found a way to make it a modest source of income. While that income could go down, I believe it’s far more likely to go up.

The Lucky Part – I feel like I won the sperm lottery. No, I can’t dunk a basketball, and I’m far from a supermodel, but I was born to parents who made it their job to get me ready for the world with as little friction as possible. Not only did they stress education and employability, but they paid for all of my schooling, no questions asked. They also stressed saving for retirement as soon as I was able to do so. Fortunately, I listened. Finally, while they lived well, they didn’t live above their means – never bought the McMansion, never drove fancy cars, never had a second house, unlike many of my friends’ similarly-situated parents.

The Part We Chose – Hanna and I elected not to have children for a variety of reasons. Finances were one of them, but at most a minor one. Most of our peers have children. While they were paying for braces and travel sports and dance leotards and trips to Disney, we weren’t. That meant that even though we make less than some of them, we often ended up with more discretionary income.

The Part that Held Us Back – While we make solid incomes, we live in an area that costs far more than average. Real estate, taxes, even consumables cost us more. In the long term, we’ll likely get some of that back, as our house has appreciated substantially since I bought it in 2003, but in the short term we’re behind people making the same amount elsewhere. As one friend said when he moved from here to Wisconsin: “I went from lower middle class to upper middle class without getting a raise.”

The Circumstances That I Think Apply Almost Universally

The Power of Compound Interest – Again, I’m thrilled that my parents encouraged me to save for retirement early. Time is your friend in investing. Yes, there are ups and downs, but over time the market has never let us down. Here’s a counterintuitive brain teaser someone told me: Would you rather have a thousand dollars a day for 30 days, or would you rather start with a penny on day one and have your addition double each day (i.e., 1 cent, 2 cents, 4 cents, 8 cents, and so on)? It seems like the former would be far more ($30,000), but with the latter you’d have over $5 million dollars. Don’t expect your money to double daily or yearly, but the point is the same – start early and small amounts will add up. Furthermore, if your employer offers any sort of match or contribution, make sure you get all of it. It’s free money.

Three-legged Stool – Historically, the “three-legged stool of retirement” has been Social Security, private pensions and savings/investment. I have no idea what the future of Social Security holds. Most Americans don’t have pensions anymore. I’ve addressed savings/investment in other bullet points here. I want to introduce a different three-legged stool: You need to make money, you need to save money, you need to invest money. Unless you make a ridiculous salary, you can’t ignore any of the three. They work in concert. Become educated to the best of your ability about all three.

Live Below your Means – This is a follow-up to the point I made above. If you spend more than you have, you’re screwed. If you spend all that you have, you’re likely screwed, too. The FIRE movement is not for me, but I also don’t live particularly high on the hog. I spend on things that matter to me – fishing gear, travel, eating out. I don’t spend heavily on things that don’t matter as much to me – clothing, art, furniture. I recently replaced a nearly 15 year old Suburban for a tow vehicle. Most of my peers would have replaced it anywhere from 5 to 10 years ago. I had no reason to do so. By the way, I paid for the Suburban with cash in 2011 – all of those would-be payments went to other things. I bought the new one with cash, too.

Honestly Assess Your Values – This is a corollary to the idea of living below your means. Unless you have serious “FU Money,” you’re going to need to make choices about how to spend if you don’t want to overspend. While I hadn’t had a new vehicle in forever and never upgraded my “starter home,” I’ve been good at treating myself to things that matter to me. I’ve gotten a new boat every four years since 2006. I travel a lot – usually in economy because I’d rather have more trips in economy than fewer in business class. If I see a piece of tackle that I want, like a saltwater Shimano Stella, I buy it. I don’t feel deprived in the least. In fact I feel beyond lucky that I have the ability to have these sorts of items and experiences.

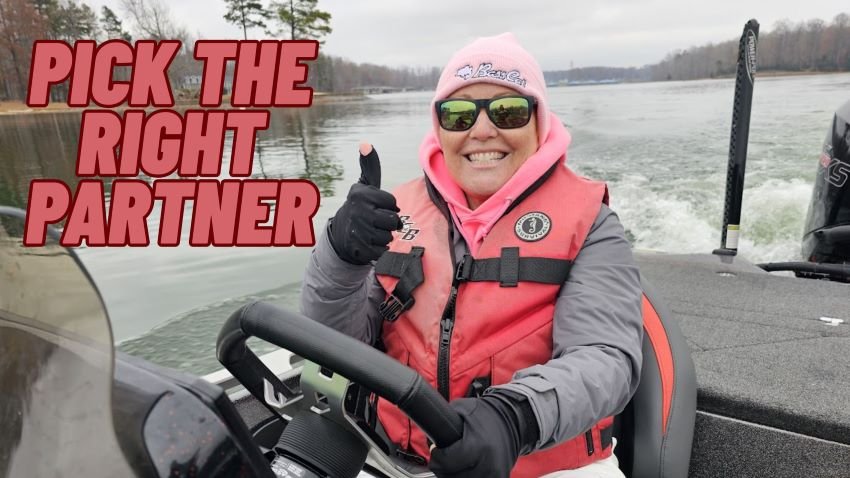

Pick the Right Partner – Besides that whole gooey love thing, having two incomes is usually better than one. But choosing a spouse whose monetary values aren’t the same as yours is a recipe for relationship disaster as well as financial disaster. It may not seem romantic, but discuss these hard issues before you make a long term commitment. Hanna and I were more or less on the same page before we married, and we’ve probably gotten closer on that front over the last twenty years. We were never exactly the same, though – I think she’s benefitted from me teaching her how to spend when it will give her joy, and I’ve benefitted from her more careful approach to saving and investing money.

Enlist Professionals – You may be the best neurosurgeon, pilot or bass angler in the world but that doesn’t mean you know what the hell the market is going to do, or how to legally minimize taxes. In fact, some of the most successful (and well-compensated) people I know in other fields are the worst at managing their money. I know several doctors who basically squandered all of their earnings because they didn’t trust others to help or believed they knew more than the experts. We have a financial advisor, we have an accountant and we have a lawyer. I may not be their most high-maintenance clients, but I’m not afraid to ask questions, either. Just be careful – there are lots of grifters out there, so only go with reputable firms/professionals with long-term track records of success. If you’re not comfortable with them, run. It’s probably a sign.

Talk About Money – There’s a widespread consensus that it’s tasteless to talk about money. I agree with that to a point – I’m unlikely to go up to a casual acquaintance and ask how much they paid for an engagement ring, or how much money they make in a year. At the same time, all of the financially savvy people I know think and talk about monetary issues all the time. They often became wealthy because they considered the various economic impacts of an investment or action. To that point, an investment in one asset class might produce the exact same amount as an investment in a different one, but their treatment for tax purposes could be wildly different. The decision to purchase business equipment on December 1 could have very different implications that purchasing it a month later on January 1. In the right environment, ask your trusted friends and professionals about these issues.

I recognize that there’s no one-size-fits-all solution, and it remains to be seen how my mid-50s retirement will work out. For the record, I feel pretty good about it. I’m financially conservative and the numbers add up. The goal is to give yourself maximum flexibility so you can walk away at the right time for you given all of the factors in play. Even if it doesn’t come down to full-on retiring, it might enable you to walk away from a job you don’t love, take a sabbatical, take on an opportunity with a huge potential upside, or try a job that pays substantially less because you’ve built up a cushion.

I’m going fishing.